All Categories

Featured

Table of Contents

Passion will certainly be paid from the day of fatality to day of settlement. If fatality results from natural causes, fatality earnings will certainly be the return of premium, and interest on the premium paid will go to an annual effective price specified in the policy agreement. Disclosures This plan does not assure that its profits will certainly be adequate to spend for any type of certain solution or goods at the time of requirement or that services or goods will certainly be offered by any certain carrier.

A total statement of insurance coverage is discovered just in the plan. Rewards are a return of costs and are based on the real death, expenditure, and investment experience of the Firm.

Irreversible life insurance policy creates cash value that can be borrowed. Policy financings accumulate interest and unpaid plan finances and interest will certainly lower the fatality advantage and cash worth of the plan. The amount of cash value readily available will generally depend on the sort of irreversible policy bought, the quantity of coverage purchased, the length of time the policy has been in pressure and any impressive policy lendings.

Associate web links for the items on this page are from companions that compensate us (see our advertiser disclosure with our checklist of companions for even more details). Our viewpoints are our very own. See how we rate life insurance policy items to write impartial product evaluations. Burial insurance policy is a life insurance policy policy that covers end-of-life costs.

Interment insurance needs no medical examination, making it accessible to those with clinical conditions. The loss of a liked one is emotional and stressful. Making funeral prep work and finding a method to pay for them while regreting adds an additional layer of stress and anxiety. This is where having funeral insurance, likewise called final expenditure insurance coverage, comes in convenient.

Streamlined issue life insurance coverage calls for a health assessment. If your wellness condition disqualifies you from conventional life insurance policy, funeral insurance policy might be a choice. Along with less health and wellness exam needs, interment insurance coverage has a fast turn-around time for approvals. You can obtain insurance coverage within days or perhaps the very same day you use.

Pre Need Insurance Meaning

, burial insurance policy comes in a number of forms. This policy is best for those with mild to moderate wellness problems, like high blood stress, diabetic issues, or asthma. If you do not desire a medical exam however can qualify for a streamlined issue plan, it is usually a far better bargain than an ensured problem plan due to the fact that you can get even more insurance coverage for a less expensive premium.

Pre-need insurance policy is dangerous since the beneficiary is the funeral chapel and insurance coverage is details to the chosen funeral home. Should the funeral chapel go out of organization or you relocate out of state, you might not have protection, and that defeats the function of pre-planning. Furthermore, according to the AARP, the Funeral Consumers Partnership (FCA) encourages against purchasing pre-need.

Those are basically funeral insurance policy policies. For guaranteed life insurance coverage, costs computations depend on your age, gender, where you live, and coverage amount.

Final Expense Insurance Agent

Burial insurance coverage offers a simplified application for end-of-life insurance coverage. The majority of insurance policy business require you to speak with an insurance coverage representative to get a policy and get a quote. The insurance coverage agents will request your individual details, get in touch with info, financial info, and insurance coverage choices. If you determine to buy a guaranteed concern life policy, you won't need to undertake a clinical test or set of questions - life insurance and funeral cover.

The goal of living insurance is to alleviate the concern on your loved ones after your loss. If you have a supplementary funeral plan, your loved ones can utilize the funeral policy to manage last expenditures and get an instant disbursement from your life insurance coverage to manage the home mortgage and education prices.

People that are middle-aged or older with clinical conditions may think about burial insurance, as they may not get approved for typical policies with stricter approval criteria. Additionally, funeral insurance coverage can be practical to those without considerable cost savings or traditional life insurance protection. top rated final expense insurance companies. Funeral insurance policy varies from other sorts of insurance policy in that it supplies a reduced survivor benefit, generally only enough to cover expenditures for a funeral service and various other connected prices

Information & Globe Report. ExperienceAlani is a former insurance policy fellow on the Personal Finance Expert group. She's reviewed life insurance and pet dog insurance provider and has created countless explainers on travel insurance policy, credit history, debt, and home insurance. She is enthusiastic about demystifying the complexities of insurance coverage and other personal finance topics to ensure that viewers have the info they require to make the most effective money decisions.

The Best Final Expense Insurance

Final expense life insurance policy has a number of advantages. Last expense insurance policy is often suggested for seniors who may not qualify for traditional life insurance policy due to their age.

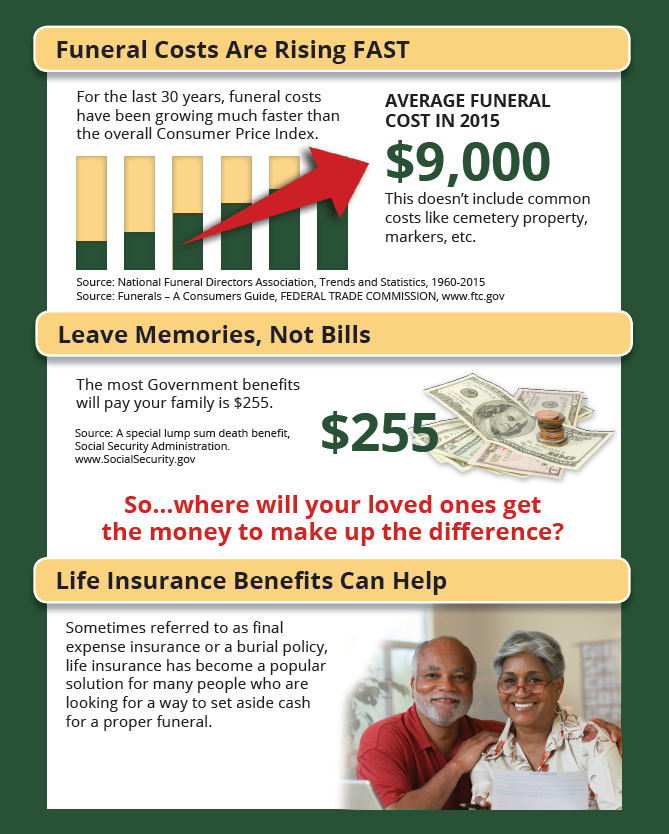

Additionally, final expense insurance coverage is valuable for individuals who intend to pay for their very own funeral. Interment and cremation services can be pricey, so final cost insurance policy gives tranquility of mind understanding that your loved ones won't have to utilize their financial savings to spend for your end-of-life arrangements. Nevertheless, final expense insurance coverage is not the ideal product for everyone.

Obtaining entire life insurance coverage through Values is fast and very easy. Coverage is readily available for elders in between the ages of 66-85, and there's no clinical examination called for.

Based upon your responses, you'll see your estimated price and the amount of coverage you receive (between $1,000-$ 30,000). You can buy a plan online, and your coverage starts promptly after paying the initial premium. Your rate never changes, and you are covered for your entire lifetime, if you proceed making the monthly repayments.

Buy Funeral Insurance Online

Last expenditure insurance policy supplies advantages however calls for cautious consideration to establish if it's right for you. Life insurance policy can deal with a selection of monetary demands. Life insurance policy for final expenditures is a sort of irreversible life insurance made to cover costs that occur at the end of life - expenses insurance. These policies are reasonably very easy to get approved for, making them ideal for older people or those that have wellness concerns.

According to the National Funeral Supervisors Organization, the typical price of a funeral service with interment and a viewing is $7,848.1 Your enjoyed ones might not have access to that much money after your death, which might include to the stress and anxiety they experience. In addition, they might experience various other prices connected to your death.

It's generally not pricey and relatively simple to get (funeral policy for over 80). Last cost protection is in some cases called interment insurance, yet the cash can pay for virtually anything your liked ones require. Beneficiaries can make use of the fatality advantage for anything they need, permitting them to deal with the most pressing financial top priorities. In most cases, enjoyed ones spend money on the following things:: Spend for the interment or cremation, seeing, location leasing, officiant, flowers, catering and more.

: Employ specialists to help with taking care of the estate and navigating the probate process.: Shut out represent any end-of-life therapy or care.: Settle any type of other financial obligations, consisting of vehicle fundings and credit history cards.: Recipients have complete discernment to make use of the funds for anything they require. The cash can even be utilized to develop a legacy for education and learning expenditures or donated to charity.

Table of Contents

Latest Posts

Budget Funeral Insurance

Funeral Cost Insurance Uk

High Risk Burial Insurance

More

Latest Posts

Budget Funeral Insurance

Funeral Cost Insurance Uk

High Risk Burial Insurance